The U.S. Department of Labor has introduced significant updates to the Fair Labor Standards Act (FLSA) with the new overtime rule, extending overtime protections for millions of workers. These changes, effective July 1, 2024, are designed to ensure fair compensation for employees who work beyond the standard 40-hour workweek. As a business owner, how will the new overtime rule impact your operations and what should you be prepared for?

New Overtime Rule: Everything You Need to Know

The Fair Labor Standards Act (FLSA) ensures that employees are compensated for overtime, but recent changes brought forth by the new overtime rule have expanded its scope significantly. Here’s a breakdown of what the new overtime rule entail and who they will affect:

Key Changes Introduced by the New Overtime Rule

The Department of Labor’s new overtime rules a pivotal update in how overtime is calculated and who qualifies for it:

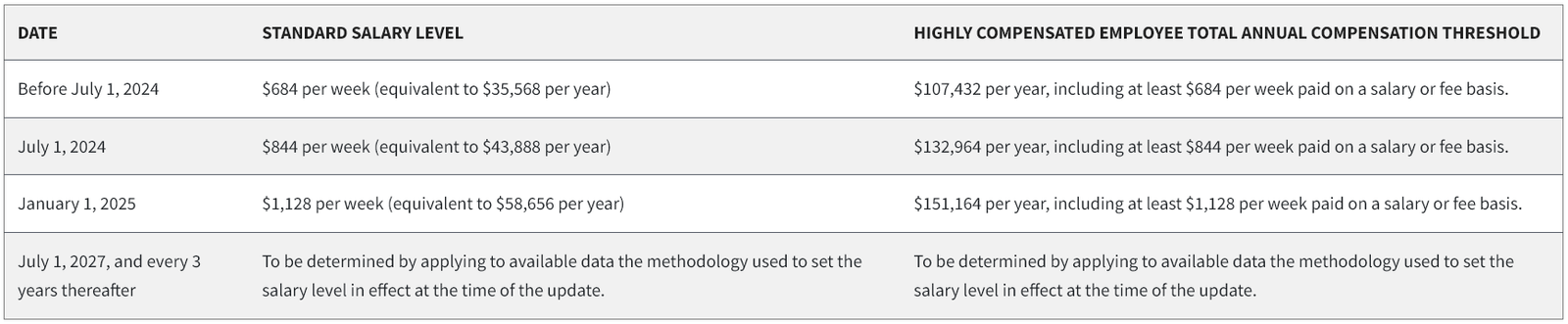

- Increased Salary Thresholds: The most significant change brought by the new overtime rule is the increase in salary thresholds for overtime eligibility. Effective July 1, 2024, the threshold will be raised from the current $684 per week ($35,568 annually) to $844 per week ($43,888 annually). This adjustment means that employees earning less than this new amount will be eligible for overtime pay.

- Further Increase in 2025: On January 1, 2025, the threshold will see another increase, this time to $1,128 per week ($58,656 annually). This ensures that more workers are compensated for overtime as salaries generally increase over time.

- Automatic Updates: A crucial component of the new overtime rule is the introduction of automatic updates every three years, starting from July 1, 2027. These updates will adjust the salary thresholds based on the 35th percentile of earnings for full-time salaried workers in the lowest-wage Census region, ensuring that the thresholds reflect current economic conditions.

- Highly Compensated Employees: The threshold for employees deemed “highly compensated” also increases under the new rule. From July 1, 2024, the new minimum for these employees will be $132,964 annually, up from $107,432, with a subsequent increase to $151,164 on January 1, 2025.

The new overtime rule is designed to expand overtime protections to millions more workers, ensuring that employees who work long hours are adequately compensated.

Who will be paid overtime?

- Employees earning less than the specified new salary thresholds.

- Primarily non-managerial staff who do not fall into the exempt categories of executive, administrative, and professional roles as defined by the FLSA.

Who will be exempted?

Employees whose roles are categorized as executive, administrative, or professional (EAP) and who earn above the new salary thresholds will remain exempt from the new overtime rule.

To fall within the EAP exemption, an employee generally must meet three tests:

- be paid a salary, meaning that they are paid a predetermined and fixed amount that is not subject to reduction because of variations in the quality or quantity of work performed;

- be paid at least a specified weekly salary level; and

- primarily perform executive, administrative, or professional duties, as provided in the Department’s regulations.

Key changes in overtime salary thresholds

Bad News for Business Owners

The new overtime regulations set to take effect in July 2024 may pose several challenges for business owners, particularly in terms of financial and administrative adjustments:

Increased Labor Costs

With the rise in salary thresholds, a significant number of employees who were previously exempt will now qualify for overtime pay. This change means:

- Higher Payroll Expenses: Employers will need to increase their budget allocation for payroll to accommodate overtime payments, which could substantially elevate operating costs.

- Impact on Profit Margins: For businesses operating with tight profit margins, particularly in sectors like retail and hospitality, these increased costs might lead to reconsideration of staffing and hours.

Administrative Adjustments

The rule not only impacts financial planning but also requires administrative overhaul:

- Payroll System Updates: Businesses will need to update their payroll systems to manage the new salary thresholds and track overtime accurately.

- Employee Reclassification: Some employees may need to be reclassified from exempt to non-exempt status based on their earnings and job duties, which involves reviewing job descriptions and possibly adjusting roles and responsibilities.

- Training and Compliance: Ensuring that HR teams and management are up-to-date with the new rules to avoid costly compliance issues.

Planning and Forecasting Challenges

Adapting to the new rule requires strategic planning and may affect long-term business decisions:

- Workforce Management: Employers might need to change how they manage workloads and employee hours to keep overtime costs manageable.

- Strategic Hiring: The increased cost of overtime may lead businesses to consider hiring more part-time workers or automating certain processes to reduce dependence on overtime hours.

Good News for Business Owners

While the new overtime regulations may present initial challenges, they also bring significant benefits that can foster a more positive workplace and strengthen your business in the long run:

Enhanced Employee Satisfaction and Retention

The introduction of fairer compensation for overtime work can lead to several positive outcomes:

- Boosted Morale: Employees who feel fairly compensated are generally happier and more motivated. This positive change can lead to increased productivity and a more vibrant workplace atmosphere.

- Lower Turnover Rates: Fair compensation helps in retaining talent. Reducing turnover not only saves costs on recruitment and training but also maintains a more experienced and cohesive team.

Opportunity for Organizational Growth

Implementing these changes can serve as a catalyst for broader organizational improvements:

- Reevaluation of Work Processes: The need to manage overtime costs more efficiently can lead you to discover more efficient work processes or innovative solutions that enhance productivity.

- Investment in Employee Development: Encouraging a shift towards higher productivity within standard working hours can also prompt investment in employee training and development, which enhances skill levels and operational efficiency.

Fostering a Fair Workplace Culture

Committing to fair labor practices enhances your reputation, not just among your employees but also within your industry and customer base:

- Enhanced Brand Image: Being known as a fair employer can enhance your brand’s appeal to potential employees and customers alike, attracting top talent and loyal customers.

- Corporate Responsibility: Adhering to ethical practices boosts your corporate social responsibility profile, aligning with broader business trends towards sustainability and ethical operations.

Where Do You Stand? Is This Good News or Bad News?

How will the new overtime rule impact your business when it takes effect in July? Have you considered how the updated salary thresholds might affect your staffing and payroll costs? What are your thoughts on these changes—are they a step forward for fairness in the workplace, or do they pose challenges for business operations? I invite you to share your perspectives and experiences in the comments below. Let’s discuss the implications together and explore how these changes are viewed across different industries.

Sources:

https://www.dol.gov/agencies/whd/overtime

https://www.dol.gov/agencies/whd/overtime/rulemaking

For more detailed guidance or to discuss how these changes might affect your business, contact me today at ronscoffrey@gmail.com or call 404-626-1425. Don’t forget to subscribe to our newsletter for weekly insights and updates!